10+

Protocols Intergration

50+

Experts Team

1000+

Wallet Register

10M+

TVL

Audit With

<Mechanism>

Secure Growth for Your DeFi Assets

Empowering Your Crypto Journey with Smart Yields with Fixed yield, Floating rate or even better, a referal program to sharing the profit from protocol.

Fixed Yield

Earn consistent, predetermined interest with our fixed-term, fixed-rate solutions. Perfect for investors prioritizing stability and reliable growth in their DeFi portfolio

Floating Yield

Optimizing your returns in real-time. Benefit from the potential of higher earnings while our sophisticated algorithms navigate the DeFi landscape.

Fordefi Custody

New feature of Protect your DeFi investments with Fordefi Custody. Our cutting-edge security measures and adherence to industry best practices ensure the safety and integrity of your assets.

VeToken Vault

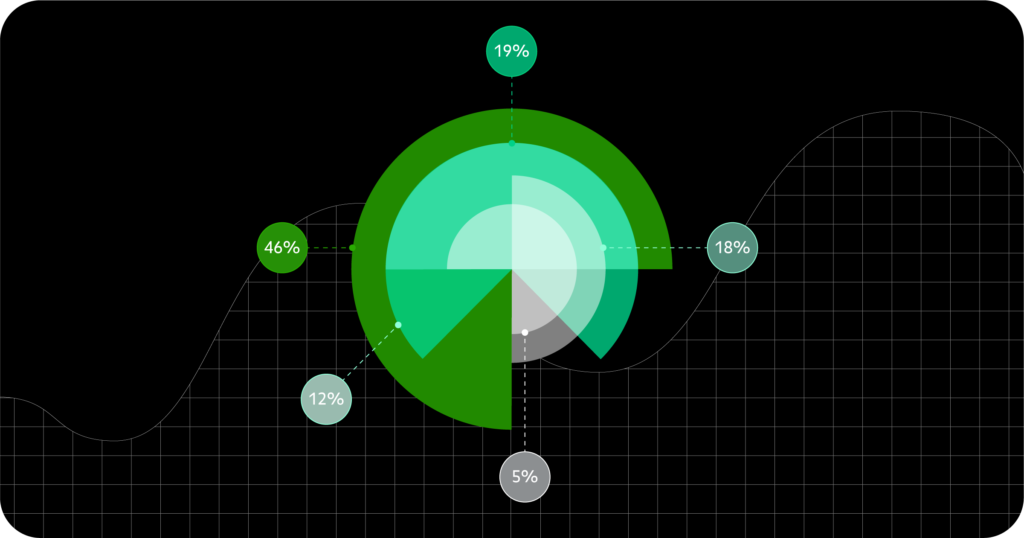

Designed for those who seek more. More yield, more influence, more rewards. By participating, you’ll unlock a tiered system of benefits, powered by veToken and our innovative Share Vault mechanism.

Featured Works

Next-Generation Crypto Porfolio Management Protocol

FAQ

What is Solomon Finance and how does it work?

Solomon Finance is a DeFi (Decentralized Finance) platform that helps users grow their crypto assets through various investment strategies. It offers fixed yield and floating yield products, a unique veToken-powered Share Vault for earning rewards, and secure custody solutions. Users can deposit assets like USDC and BTC to earn interest and participate in the platform’s incentive programs.

What are the benefits of using Solomon Finance’s veToken (Share) Vault?

The veToken (Share) Vault, also known as the Share Vault, allows users to stake their assets and earn points, which can be amplified by holding veToken and referring others. Benefits include boosted yields on deposits, potential governance rights, and access to exclusive features. The more veToken you hold, and the longer you stake, the higher your earning potential.

What is the difference between Fixed Yield and Floating Yield on Solomon Finance?

Fixed Yield products offer a guaranteed, predetermined interest rate for a set period. Your returns are locked in and predictable. Floating Yield products offer variable interest rates that fluctuate based on market conditions. While potentially offering higher returns, they also carry more risk.

How does the Solomon Finance points system work?

The Solomon points system rewards users for depositing assets into the Share Vault. Points are calculated based on your deposit amount, veToken holdings, referral activity, and the duration of your deposit. These points then determine your share of the platform’s distributed rewards (typically in USDC).

Is Solomon Finance safe and secure?

Solomon Finance prioritizes security and employs various measures to protect user assets. These include smart contract audits, the use of institutional-grade custody solutions like ForDeFi Custody, and ongoing security monitoring. However, as with any DeFi platform, there are inherent risks, and users should always do their own research.

What is ForDeFi Custody and how does it relate to Solomon Finance?

ForDeFi Custody appears to be Solomon Finance’s institutional-grade custody solution, likely offered as a separate service or integrated feature. It provides secure storage and management of digital assets, adhering to industry best practices for security and compliance. This is especially important for larger investors and institutions.

How do I get veToken on Solomon Finance?

The details on how to obtain veToken are not fully specified in the provided text. However, it likely involves locking up USDC or the platform’s native token for a specific period within the Share Vault. The longer you lock your assets, the more veToken you likely receive. More details are needed on the exact mechanism.

What are the fees associated with using Solomon Finance?

The provided text doesn’t specify the exact fees. However, common fees on DeFi platforms include performance fees on earned interest, transaction fees for interacting with smart contracts (gas fees), and potentially withdrawal fees. You’ll need to consult the platform’s documentation for precise fee details. Based on the earlier context, Solomon takes a performance fee from fixed term products, and will take a cut of the floating yield profits.

What assets does Solomon Finance support?

Based on the information provided, Solomon Finance supports at least USDC and BTC (likely wrapped BTC on a compatible blockchain). More details are needed to confirm whether they support other assets.

How can I maximize my earnings on Solomon Finance?

To maximize earnings on Solomon Finance, you can:

- Take advantage of any applicable promotions or bonuses offered by the platform.

- Deposit assets into the Share Vault and participate in the points system.

- Hold veToken to boost your points and rewards.

- Refer other users to the platform to earn referral bonuses.

- Choose Fixed or Floating Yield products based on your risk tolerance and market outlook.

- Consider locking assets for longer periods to get time-based multiplier

Boost Your Ownership Today!

Deposit to owner vault to get more multipler for each season, share more profit from protocol and refferal.